This form is a vital part of your claim and must be retained as evidence as part of your

self-assessment

submission.

Most seafarers will agree that it is a lengthy and time-consuming task, involving printing and manually

completing the form. This is why we have created our easy-to-use online tax days calculator which takes the

hard work out of calculating your days at sea.

Use the calculator below by entering the dates you left and returned to the UK. Simply add a row for each

individual period you spent offshore.

Once you've added all your dates, our system will display an instant number of days you spent

outside the

country. The total will tell you whether you have accumulated enough days to qualify under the SED or

otherwise.

Calculate Your Tax Days

Enter your leaving and return dates below to calculate how many days you have been outside

of the UK within the last year.

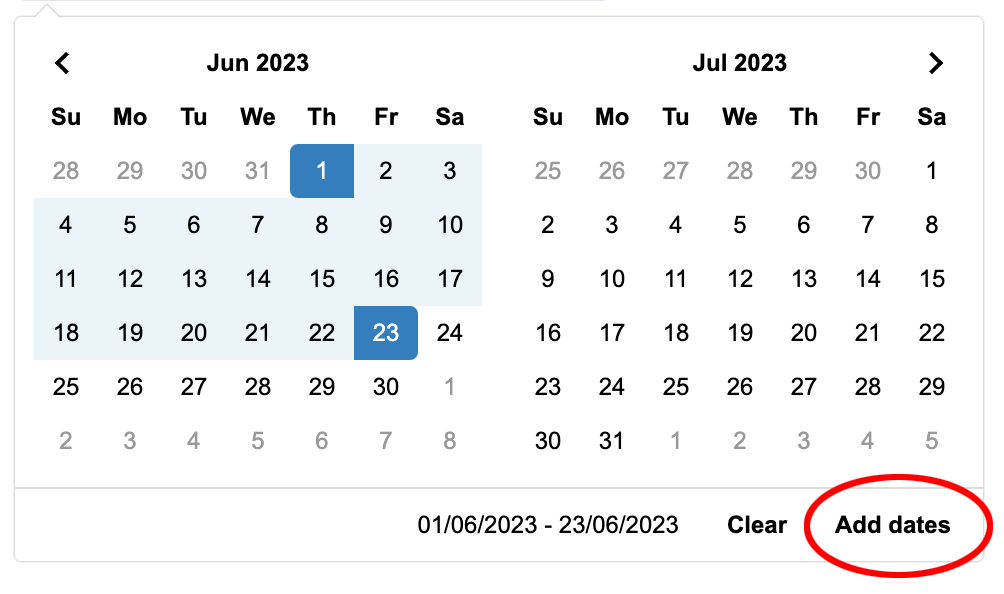

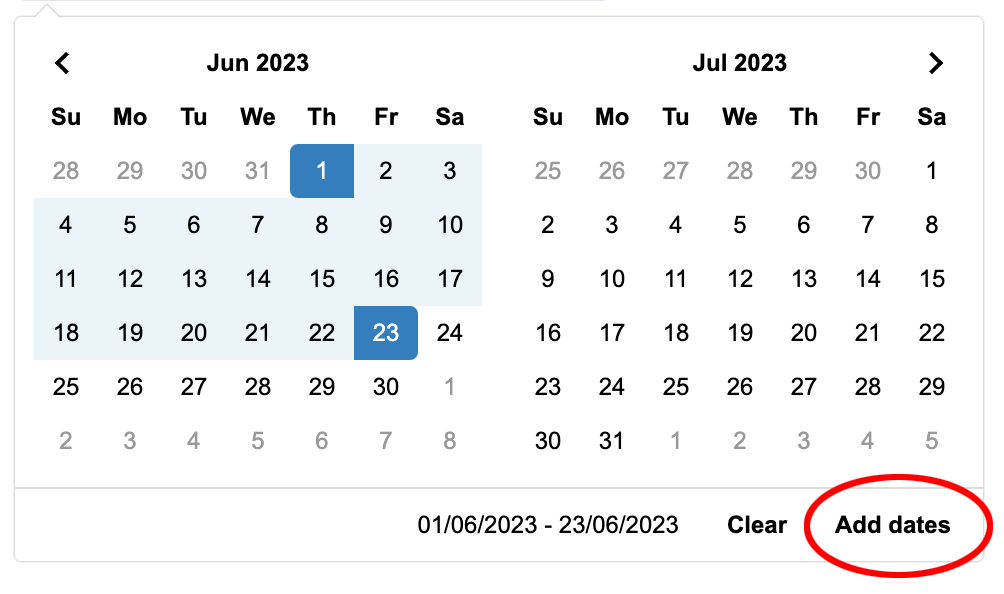

Add a new row for each individual period, making sure you click the 'Add dates' button for each entry (see screenshot below):

You have spent 0 days outside of the country

*Initial Qualifying Period

In order to establish a qualifying period for the Seafarers Earnings Deduction (SED), you will need to

establish an initial period of 365 days in which you spend less than 183 days in the UK.

Your day count will begin from the first day you set foot upon a vessel and based upon a rolling 365 day

period rather than a tax or calendar year.

In order to finalise and confirm this initial period, you must also be outside the UK at midnight on the

365th day following your first day onboard.

Half Day Rule

Once your initial 365 day qualifying period has been established as above, HMRC will view your qualification

as an extended period.

As long as you have spent less than half your time in the UK over the period since you first began a claim,

and you do not spend 183 consecutive days in the UK, your claim will continue to be valid.

Need Some help?

Do you need some help using our tax days calculator? Or perhaps you've calculated your tax days and would

like some assistance filing your self-assessment tax return?

Our professional team of accountants and tax experts are ready to answer your questions.

Call us today on +44 7872 812765 or contact us via email

and we'll be happy to help.